Junior Accountant Profession Essay

Junior Accountant Profession Essay

Junior Accountant Profession

Junior accountant profession is undertaken by candidate who graduates from colleges with degrees in any accounting field. The main purpose of establishing this profession was for the sake of the need to provide support in the entire department of accounting in all organizations. The main roles of the junior accountant are processing, recording, updating and reconciling the fiscal information in accordance with the established accounting policies and standards. They also offer recommendations and suggestions to the entire accounting team on the best ways to provide financial information to the users.

Many of the fresh graduates in the accounting profession begin their career as junior accountants. The entry level position of the accounting field serves as the basic level in which the new recruits begin their career. At this position the new recruits are exposed to the basic accounting activities in order to gain more experience in the field. This profession has a well-structured career development path and the graduates entering the field as junior accountants can undergo further education to attain more academic qualifications (Harris 58). They are also subjected to continuous training to boost their skills and experience in order to be in a position to perform their services in a better manner. Through acquiring more advanced educational knowledge the profession, junior accountants can rise from the entry level position of their career to the top most level of chief accountant of the entire organization.

Junior accounting profession has been considered as the foundation of the accounting practice in many accounting firms. This is because many junior accountants begin their accounting career at this point by working in business related fields. They continue to more advanced levels due to the excitement and passion developed out of the activities involved in accounting process (Hamilton 39). The junior accountants are expected to be quick learners and people of high integrity because they handle issues that determine the performance of the entire organization. They are the staff used in the preliminary analysis of the company budgets hence their credibility in the profession is highly expected. The basic activities performed by junior accountants require a lot of experience through training because accuracy is a major requirement in the entire profession.

This profession tends to be very dynamic because the junior accountants are expected to take part in almost all the financial issues of the company. This diversity compels them to strive for more academic qualifications and accounting skills in order to be in a position to offer quality services in the accounting department (Harris 58). Even though the level of education provides a platform upon which the career development path in this profession is bestowed, the level of experience is very crucial to gauge the ability of employees to perform better in a more advanced position. Junior accountant profession is one of the most challenging professions because the new recruits are required to perform wide range of duties within their scope of work. Therefore, the length of the period that a junior accountant has spent in the entry level position will determine the magnitude of skills and knowledge he or she possesses to warrant promotion.

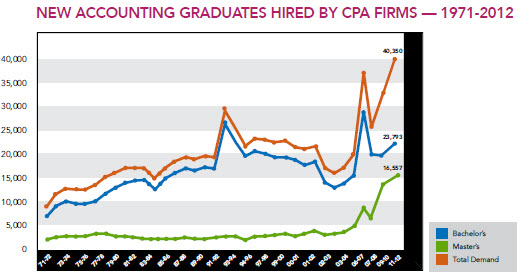

Many companies are experiencing a continuous increase in demand for junior accountant professionals. These professionals are widely required to offer the required support in all the departments in an organization especially the accounting department. Despite the current demand being reported to be already high, it is projected that it will increase in the coming years as the accounting industry grows day by day (Hamilton 42). The demand is expected to rise because many accounting schools are struggling to expand their capacity to produce more accountants to meet the rising demand. The rising need of accountability and transparency in many companies has accelerated to need for more qualified junior accountants. The senior accounting staff may be very strained in their attempt to offer true and fair financial reports without the help of the skilled junior accountants.

Figure 1: Trend of demand of Junior Accountants in United States.

Public sector accountancy is expecting an increase in demand for junior accountants as contract work prepares for surge. According to a research by Giant Group a recruitment firm, it approximates that only 19 percent of the accounting staff surveyed were members of the accounting professional bodies. This survey indicates a rapid increase in demand for junior accountants to work in midlevel positions in the accounting firms. The high need for such professionals relates to the increased demand for specialists in the management consultancy and the accounting firms (Howieson 9). Giant Group managing director Mathew Brown states that the rising demand of low level accountants is attributed to the introduction of hourly basis contractual work. The projected future demand for the junior accountants can only be resolved through encouraging of more students to enroll in such academic field by raising the salary scales for new recruits in the accounting profession.

Many students find the accounting profession challenging especially for the junior accountant position that require high degree of skill and care when performing the accounting activities. The junior accountants play an important role in the accounting department by ensuring that the financial statements are completed during the specified field. In the performance of their duties, junior accountants ensure completeness of the financial statements, accuracy of all the information provided and ensures full compliance with the uniform accounting standards set by the accounting bodies (Hamilton 45). In order to attain the required minimum entry into this profession, candidates are required to possess some academic qualifications. Apart from the academic qualification, candidates intending to become junior accountants should qualify for specific moral values such as honesty, confidentiality and time consciousness required for quality delivery of their services.

Due to the complexity of the entire accounting profession, new recruits joining the field are expected to go through various steps in order to enter the profession. They need to acquire the necessary education because it serves as the basic qualification to enter the field. The second step is to gain the relevant skills and experience through continuous training process provided by the accounting firms (Jackling 5). The final step of entering the profession is the acquisition of licensing and certification to enable the graduates get the required authorization to practice accounting. The above discussed methods of joining the accounting profession are very important because they ensure that the candidates are fully qualified to perform their duties in the various departments allocated.

The minimum education level required to get an accounting job is a Bachelor’s degree in Accounting. Although there is preference for candidates with master’s degree, the entry level position of a junior accountant is basically the attainment of a bachelor’s degree. According to employment reports and projections by the Bureau of Labor Statistics from 2012 through 2022, the job prospectus in the accounting profession will be more favorable for recruits with more advanced degrees. The academic qualification is termed as the basic requirement because it ensures the candidate has basic knowledge about the entire field (Leong and Serafica 68). Such knowledge will make it possible for the accounting firms to easily train the junior accountants on the detailed aspects necessary in the profession.

Since the accounting profession is controlled by professional bodies that set the entire accounting and reporting framework, candidates entering the profession need to pursue these professional courses such as certified public accountants. Upon acquisition of this certificate, the accountancy professional bodies scrutinize the candidates before issuing them the formal certification that allows them to practice accounting. For example, in United States, the American Institute of Certified Public Accountants is mandated to control and monitor the entire accounting profession in United States (McManus and Subramaniam 21). This professional body was established to ensure that the members abide with the code of professional conduct in the accounting profession. It provides guidelines and rules that govern all the members in the profession ranging from those in public practices, government institutions, private sector as well as in the education sector.

Despite acquiring the necessary academic knowledge required in the accounting profession, there is great need for training once a new recruit enters the field as a junior accountant. Once the junior accountants are recruited into the accounting firms, they are encouraged to enroll in further training programs in order to improve their skills, competence and experience in the profession (Joynt, Karen, et al 66). Many multinational accounting firms such as Deloitte and KPMG have invested very much on graduate trainee programs. These programs have been key in equipping their newly recruited graduates with the necessary accounting skills that they may have not learned in their degree programs. Such programs incorporate the moral virtues and expertise required to perform very technical tasks in their daily accounting involvements.

Basically, in the accounting profession the salary scales are well structured on the basis of academic qualification and the work experience in the profession. Most of the junior accountants in United States are reported to have work experience of less than five years since their graduation. Therefore they tend to be less experienced compared to the senior accounting officers who not only have higher academic credentials but also some worth of experience in the profession. According to the United States salary scale provided by the Bureau of labor statistics, the average salary for junior accountant staff is 40,000 dollars per year (Nouri & Robert 146). Generally, their range from 30,000 dollars to 52,000 dollars per year depending on the academic qualifications they entered the profession with as well as the year of service in the field depicting their work experience in the sector.

As the junior accountants undertake more academic qualification they are promoted to senior accountant positions. Consequently, their salaries are increased to as high as 63,550 dollars per year. However, the senior accountants who have the highest level of academic qualification and have served the company for many years may earn up to 111,510 dollars per year in the climax of their profession (Nouri and Parker 142). Senior accountants are one of the best compensated executive officers in companies located in metropolitan areas of New York City, United States of America. Accounting companies located in New York City, Ocean City and Newark cities in New Jersey as well as The San Jose in California are the best paying in the entire Unites States. According to the salary pay scale survey done in United States in the year 2012, accountants earn an average salary of 71,040 dollars per year higher than bookkeeping, accounting and audit clerks who earn as low as 36,640 per year (Sawarjuwono 12). However, other fields in finance and marketing are more compensated than accounting because the survey showed that financial analysts earned 89,410 dollars per year while marketing manager earned 129,870 dollars per year.

Figure 2: Salary scale for Accountants in United States

The pay scale in the accounting profession rises as the employees advances in academics and work experience. As junior accountants are promoted to higher levels in the profession they earn more salaries and bonuses. Salary increment in this field acts as a motivator for the new recruits in the professional to work harder (Youngs 8). Accounting profession has proved to be one of the most paying professions in United States compared to other professions such as medicine or education. In the accounting field the salaries of the accountants are not much regulated by the government because many of the accounting firms are private companies. As a result, different accounting firms have distinct reward systems for their employees. Multinational accounting and auditing firms such as KPMG and Deloitte are known to pay their employees good salaries as a way of promoting retention of intelligent accountants as well as attracting the best graduates in the field looking for jobs.

As a junior accountant, there are many opportunities for advancement in the career. The career development in this field is largely determined by the ability of the employees to tackle critical financial problems. The main career development in this profession is advancement from a junior accountant, to middle level accountant and finally becoming a senior accountant in charge of all the accounting activities in the entire company (Jackling 214). Basically, the level of education is the main criterion used by the employers and the accountancy professional bodies to promote the accountants from one level of their career to another. Hence, junior accountants who join the profession with set targets and focus to grow in the field they find it very easy to climb the career ladder.

Career advancement in the accounting profession is dependent on the trainees progressing through the required professional qualifications and gaining more experience through the continuous training and exposure offered in the workplace. According to the requirements of the Association of Chartered Certified Accountants, all accountants regardless of their qualifications are required to keep their skills and knowledge in the field up to date. This ensures that they can deal with the changing needs of the clients in the market as the need for true and fair financial statements among investors increase.

Figure 3: Career development path model

Career development programs are one of the most common strategies established by many firms to boost their employee morale. Accounting firms embark on aggressive training of their new recruits to build their expertise in the field thus enabling new employees to realize their career goals. Career planning works well in developing the career path of the junior accountants as they design a formal structure of promotion in the company (Leong, Frederick & Felicisima 67). Making the junior accountants understand the next level in their career boosts their morale since they appreciate the fact that the company management is committed towards their career success. Equality in promotion has also build the reputation of many accounting companies on the minds of their employees because they are meant to be fully aware of the fair system of rewarding either in wage rates on promotional basis.

To conclude, accounting profession is one of the best areas of specialization for students interested on business related careers. Therefore, although the academic qualification is the basis of career development in this profession, experience, skills and ethical virtues majorly determines prosperity in this profession. The fact that the accounting profession is one of the best paying fields should encourage scholars to pursue accounting since many people are motivated by money. The rising demand for junior accountants indicates that the accounting profession is really growing at a high rate. In order to meet the demand for skilled accountants, the accountancy professional bodies are focusing on designing regulation policies that are consistent with the modern technology in order to attract the youths. The existence of well-designed systems for career development in accounting ensures that new recruits are able to advance from position of junior accountant to that of senior accountant.