Finance Assignment Sample

Finance Assignment Sample

HSBC Bank PLC.

Introduction

HSBC Bank PLC. is a limited liability corporation and a subsidiary of HSBC Holdings Plc. dealing in the finance and insurance industry. The bank was founded in 1836 in Birmingham, England and has grown to become one of the largest financial services provider and banking corporation in the world with over 85000 employees. The Bank is headed by Douglas Flint, who is the chairman of the whole group, Stuart Gulliver who is the group HSBC Holdings PLC. and Brian Roberts who, is the CEO for the HSBC Bank Plc. The Bank has established numerous subsidiaries in various foreign markets, launching its financial services and insurance services in at least 80 countries across Africa, the Middle East, America, the South Asia region and in Europe. The HSBC holdings Plc. holds a 100% stake in the bank thus making it a fully owned subsidiary. HSBC is a major player in the U.K banking and insurance industry given that it’s part of the top four clearing banks that are licensed by the Financial Services Authority.

About HSBC Bank Plc.’s industry

The bank has operations in the finance and insurance industry. The finance industry in which the company deals in involves the everyday banking products, premium banking, borrowing and investment. The UK banking industry is comprised of a number of banks that offer similar services. These institutions are only differentiated by the different exchange rates that they offer to their respective customers. The industry is also highly regulated by the Bank of England which formulates and enforces standards that all banks should conform to. There have been significant reforms in the U.K banking industry especially after the enactment of the Banking Reform program of 2014.

Financial Analysis of HSBC’s industry

The bank operates in the international banking sector which is continually affected by a lot of uncertainties. The global banking industry has been affected by major shocks including the global economic meltdown which led to most banks recording very low profit margins. This is attributable to the instability being experienced in the Middle East due to political tensions. Also, the African segment has adversely been affected by the Ebola crisis especially in West Africa. Such problems have driven HSBC to adopt a reform strategy that is focused in uplifting the stakeholders’ interests in terms of security of their deposits. Most banks have launched global operations including HSBC. The global markets have also been influenced by international factors such as changing technological trends, diverse cultures and fluctuating currencies.

The growth of cyber-theft has also impacted negatively on the progresses made in the global banking industry which has led into the low profit margins for major international banks.

HSBC Ratio Analysis

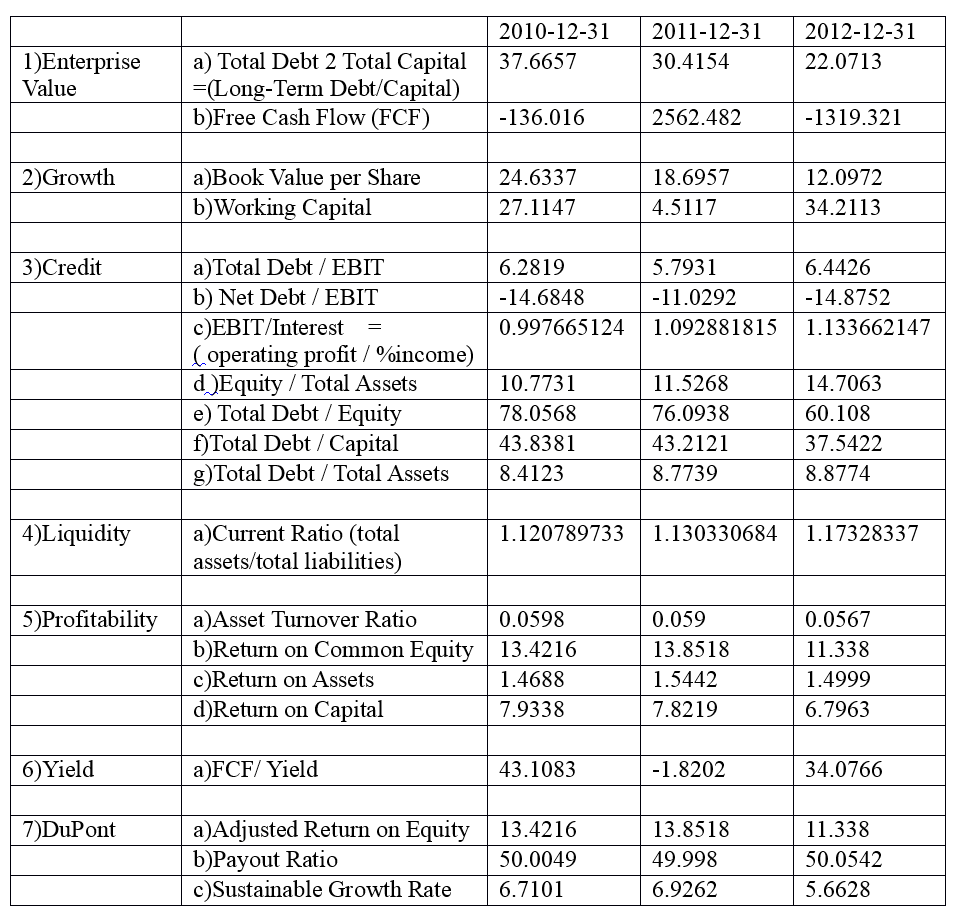

The firm’s total debt to total capital is given as 22.0159 for 2010. The analysis indicates that debt levels for HSBS exceed the amount of capital for the company. The total Debt/total Capital ratio slightly increases to 22.4593 in the following year and further increases to 31.8169 in 2012. It indicates that the firm is increasing its borrowing levels beyond the equity levels, thus the capital structure of the firm is debt financed to a greater extent than equity financed. As the definition of D/E ratio states, the ratio indicates the proportion of total capital that is equity financed and debt financed. HSBC is therefore said to have high leverage ratios thus risky for potential investors.

The book value per share for 2010 amounted to 13.5835. The ratio indicates that investors have more confidence in the performance of the firm. The ratio dramatically reduces by over 50% in the following two years, dropping to 6.543 and 6.9383 in 2011 and 2012 respectively. It indicates that there is a decline in investor’s prospects about the company’s performance. The total debt/EBIT is a ratio that compares the firm’s debt levels against the earnings before interest and tax. The ratio is high at 17.636 in 2010, which indicates that more of the EBIT are used to settle debt obligations. The ratio declines in 2011 to 14.7485and increases to 22.216 in 2012 as a result of an increase in the firm’s earnings in the latter year.

The times interest earned ratio, which is the ratio of interest that’s covered by the earnings is given as 0.41483579 in 2010, it slightly increases to 0.4559555 in 2011 and 0.33853218 in 2012. The total debt/total assets ratio is given as 11.7885 in 2010 indicating that the assets are financed by debt. The ratio decreases to 10.7389 in 2011 and 10.5843 in 2012 indicating a decline in value of assets financed through debt. The D/E ratio is given as 186.794 indicating high leverage of the firm. The ratio decreases to 165.233 in 2011 and to 155.6209 in 2012 indicating more debt repayments and a decline in the borrowing levels of the company.

The Emirates National Bank of Dubai

The Emirates NBD is the largest bank in the United Arab Emirates in terms of assets. The Bank is headed by CEO Shayne Nelson and it is listed on the Dubai Financial Market as a limited liability entity. Emirates NBD is one of the youngest banks in the world, having been founded on 16TH October, 2007 by Ahmed bin Saeed Al Maktoum after the merger of the National Bank of Dubai and Emirates Bank International. The Bank has over 220 branches which are spread across the Middle East and overseas, in addition to over 927 ATM’s and Cash Deposit Machines. The Bank has grown to become a major player with the UAE corporate environment which has enabled it to be recognized as the leading financial services provider given that it is the market leader in asset management division, private banking, investment banking and Islamic banking. Emirates NBD has a total asset base of over AED 342.1 billion based in the UK, Qatar, Singapore, Saudi Arabia, UAE, Egypt, Indonesia, China and India.

About Emirates NBD Industry

The Indian banking industry has recorded high growth levels in the recent years. The enactment of the Banking Laws (Amendment) of 2012 introduced several changes in the Indian banking industry. All the players in this market are regulated by the Reserve Bank of India. The industry regulator is also mandated to issue licenses for new banks that wish to set up banking businesses in India. The industry has been akin in the economic progress of India creating over 2 million jobs. The total market size of the Indian banking market is valued at $1.8 trillion as at the close of 2013. The industry is expected to cross the $28.5 trillion mark by the end of 2025.

The financial services industry in which the Emirates Bank of India operates in involves provision of economic services that involves a number of the bank’s subsidiaries such as insurance products, stock brokerage services, real estate finance and investment banking services.

The industry also involves the provision of bank cards such as debit cards and credit cards. The provision of intimidation and advisory services is also a key aspect of this industry, which involves a number of stock brokerage firms spread across the Indian market. The financial services market in India is growing as a result of growth in the importance Indian markets in the world and the emergence of India as one of the fastest growing economies in the world.

Financial Analysis of the Industry

The banking industry has recorded significant financial results in the recent past. The total bank deposits held by Indian banks amounted to $1274. 3 billion as at the close of 2013. It represents a 21.2% increase from the deposits recorded in the previous year. The credit in the Indian banking sector is expected to reach $2.4 trillion in 2017, this represents an 18.1% increase across the years. For the year ended 31 December, 2014 the banking sector in India recorded a growth rate of 18.1% in INR which was driven by growth in personal loan businesses and credit cards. The personal loan disbursements grew by 141.6% as at the end of 2014 representing the best financial prospects in the industry. The bank also has significant investments in the Indian banking sector, which have a total asset base of $1.8 trillion. (India Brand Equity Foundation, 2014).

ENBD Ratio Analysis

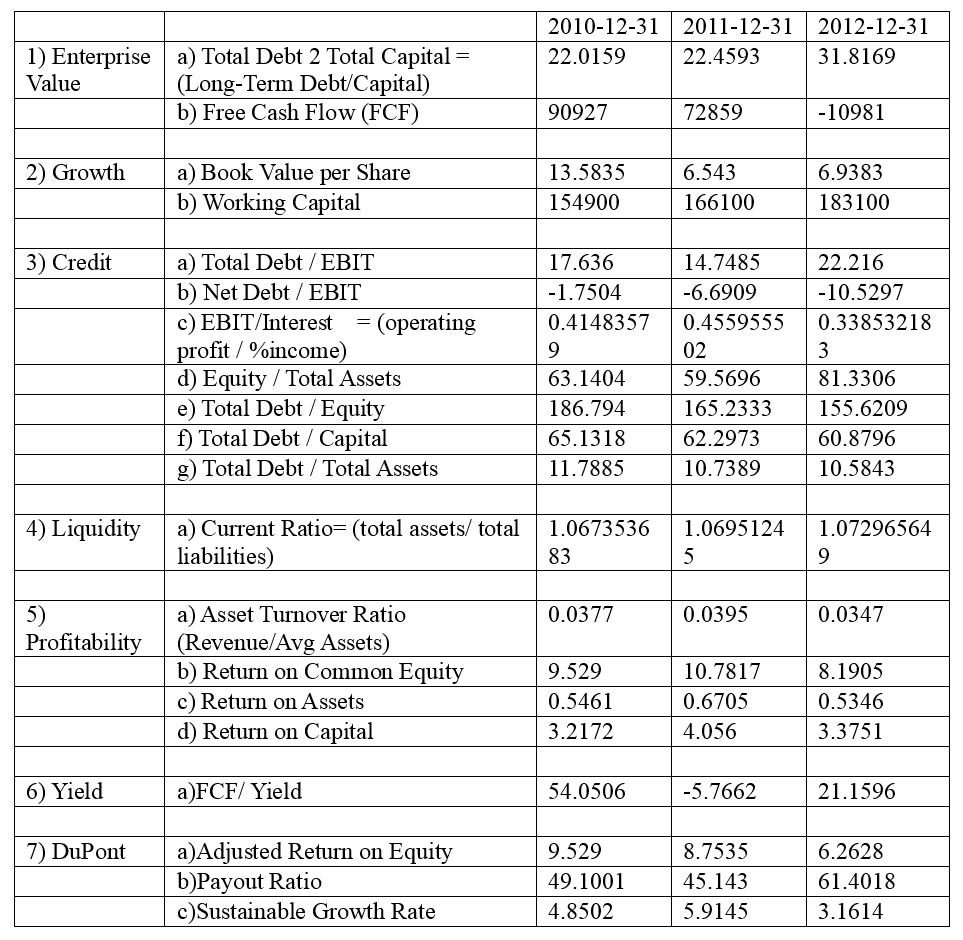

The ENBD enterprise value is negatively valued at 2010 at -4393.1155. The valuation increases in the following 2 years recording a free cash flow value of 4285.0801 and 1421.3213 in 2011 and 2012 respectively. The total debt to total capital ratio is given as 54.5041. The ratio is very high indicating that the company’s capital structure is debt financed. The ratio increases to 56.5356 in 2011 and declines again to 54.5257 in 2012. ENBD growth potential looks bleak given that the book value per share is declining across time. In 2010, the BPS is given as 5.5818, the ratio declines to 3.8003 and slightly increases to 4.3439 in 2012. The bank is said to be highly leveraged given the high debt/equity ratios of 119.8001 in 2010, 130.0731 in 2011 which again declines to 119.9047 in 2012 indicating a reduction in the firm’s leverage.

The firm sufficiently covers its interest obligations given the high time interest earned ratio. The amount of debt that is financed by EBIT is high, given a ratio 13.3687 in 2010. The ratio increases to 33.6908 in 2011 and reduces to 17.7963 in 2012. The net debt/EBIT ratio is negative in 2010 at -3.6706 indicating that the firm may not be able to meet its interest obligations in the short term. The ratio increases to 3.053 in 2011 and 4.3439 in 2012. The bank is also said to be highly liquid given the high liquidity ratios. The current ratio, which is a ratio of current assets to current liabilities is 4.164005115 in 2010, this ratio slightly increases to 4.187926626 in 2011. It slightly reduces again in 2012 to 4.166345095 in 2012 owing to the improved ability of the bank in repaying its current liabilities using the short-term assets that are available.

The asset turnover ratios are low at 0.057 in 2010, this slightly declines to 0.0505 in 2011 and 0.0473 in 2012. It means, therefore, that ENBD is inefficiently using its assets to generate sales. However, the return on equity is high given as 2.8336 in 2010, 3.2115 in 2011 and 3.1777 in 2012. ENBD is giving back more of its returns to the shareholders. It is also reflected by the high dividend payout ratios of 47.5123 (2010), 43.9172 (2011) and 54.3455 (2012). The DPOR is a ratio that compares the amount of retained earnings that are being paid out as dividends.

Barclays PLC

Barclays Plc. is a universal banking corporation that is headquartered in London, United Kingdom with operations spread over 50 countries in Asia, Africa, Europe and America. The Barclays group was founded by in 1690 and is headed by Sir David Walker, who is the group chairman and Antony Jenkins who is the group CEO. The financial services company offers a number of products such as investment management, commercial banking, retail banking and investment banking. With an asset base of $2.249 trillion as of 2013, Barclay Plc. has grown its customer base reaching the 48 million mark as at the close of 2013. The bank is listed on the London Stock Exchange with a total market capitalization of £22 billion as at the close of 2011. It is also listed on the New York Stock Exchange, trading under the BCS acronym.

The Barclay Plc. group has two subsidiaries and these include the Absa Group and Barclays Bank Plc. The Banking group is ranked the 7TH largest bank in the world due to its massive asset base and diverse operations in wholesale, retail and investment banking. The bank has over 139600 employees as at the close of 2013. The large size and multinational nature of the bank are reflected. In addition to this, the good financial performance having reported a net income of $2.224 billion in the financial year ended 31 December, 2013.

About Barclays Bank’s Industry

Barclays is an internationally-focused bank, which majors if four key market segments of personal and corporate banking, Africa, the Barclaycard and the Investment Bank. Given that Barclays bank operates internationally, the industry is wide and is comprised of a number of SME’s, individuals, institutions, multinational corporations and government agencies. The bank operates in the banking and financial services industry. The financial services industry involves the provision of financial services ranging from insurance, stock brokerage, investment banking and advisory services. The banking sector involves the provision of banking services including deposit taking and lending.

Financial Analysis of the global industry in which Barclays operates in

The global banking industry has been influenced by great uncertainties that exist in the market. There has been a shift towards nationalism, which prevents globalism as a result of the protectionist policies that are adopted by the different countries. Also, the influence of government in running the banking operations has increased significantly leading to increased regulations. Such regulations have shifted the business strategy of most global banks and business towards state capitalism and public-private partnerships. The total industry forecast in terms of assets for the industry is expected to reach $163058 billion as at the end of 2017. The CAGR rate is also expected to grow at a rate of 8% over the 5 year period ending 31 December, 2018.

The global banking industry is also expected to be greatly affected by short-term uncertainties given that it is fragmented to a larger extent.

The retail banking, investment banking and corporate banking business segment recorded good results globally. The industry is dominated by European segment, which has a 43% of the global banking market share. The Indian and Chinese market offer a lot of investment opportunities to a number of globally-focused banks. Also, the US and the rest of the North American banking industry recorded high industry profits given the relative calm that prevailed. The influence of technology was key in transforming the global banking industry, especially with regards to the rise in mobile banking and internet banking platforms.

Barclays Bank Ratio Analysis

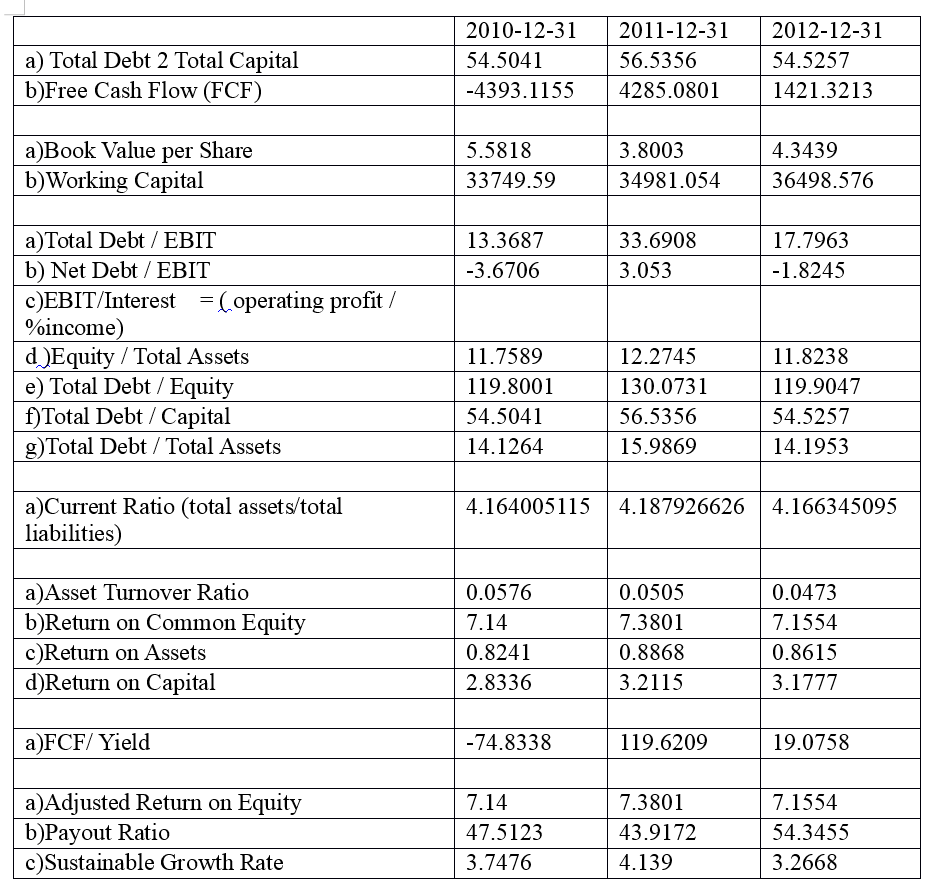

Barclays Bank enterprise value is deteriorating over time. It is indicated by the negative free cash flows of -75.76, this decreases to -100.16 and slightly improves to -70.2882. The firm’s growth potential is also deteriorating due to the declining book value per share. The book value per share is given as 35.5374 in 2010, it decreases to 4.9076 in 2011 and further declines to -8.0721 in 2012. The analysis indicates that Barclays Bank is performing poorly in the banking and financial services industry. The Barclays’ credit rating is expected to improve in 2011 given that the D/E ratio decreases to 695.13 from 780.05 in 2010. The ratio further increases to 731.17 in 2012 indicating high leverage levels for the bank.

The ratio of Total Debt/EBIT significantly increases from 84.09 in 2010 and 58.02 in 2011 up to 859.09 in 2012. It indicates that the firm is borrowing a lot, which cannot be supported by its available earnings. The return on assets ratio is declining across the years from 0.2908 in 2011, 0.2368 in 2011 and -0.0201 in 2012. It indicates that the assets are being used inefficiently. The return on capital employed is also very low given as 0.8717, it declines to 0.7566 in 2011 and further declines to 0.0065 in 2013.The firm’s short-term liquidity is low, given a current ratio of less than 2. In 2010, current ratio is 1.0439, it slightly reduces to 1.0435 in 2011 and further declines to 1.0419 in 2012. The bank is not able to repay its current liabilities using the available current assets.

The Abu Dhabi Islamic Bank

The Abu Dhabi Islamic Bank (ADIB) is a bank that is Sharia law compliant based in Abu Dhabi city, UAE. The bank was founded in 1997. The bank is known for its simplicity, transparency and compliance with the Sharia law. The Islamic bank has a widespread presence in the Islamic countries such as the United Arab Emirates opening up over 70 branches and close to 460 ATM’s. The bank has grown to become the best Islamic bank in the UAE having been ranked the best bank in terms of customer service. ADIB was founded by a number of prominent UAE nationals, members of the ruling family, the Abu Dhabi Investment Authority and Dr. Wasseem Ahmed Khan. The bank is headed by CEO Tirad AL Sheikh Mahmoud and the bank has a capital outlay of $1 billion Dirhams. The ADIB is listed on the Abu Dhabi Securities Market.

The Bank has transformed the better ways to bank by reconfiguring its website to make it easier for customers to access banking services. The Bank has also launched an aggressive social media campaign so as to get closer to the young and growing middle class segments. The ADIB has also launched the Dana Women’s Banking platform which offers a range of products and services that come with customized lifestyle benefits for women. The bank has also established other social responsibility services such as the ADIB scholarship fund, which benefits all AUS students with education grants of over AED 5 million. The bank’s chip and PIN technology is next to none thus assuring the customers of the safety of their moneys as a result of the usage of the contactless payment Pay wave technology.

The Abu Dhabi Islamic Bank operates in the United Arab Emirates Islamic banking sector. The industry offers a range of highly customized Islamic banking services that are compliant with the Sharia law. The industry has recorded significant growth potential in the recent past due to the high profits that are recorded by Islamic banks. The UAE banking sector is dominated by 8 large banks. These banks account for at least 80% of the total market share with regards to assets in addition to controlling a larger percentage of the market share of the industry.

The growth in the industry is attributed to the increased regulatory framework, thus leading to more compliance. The stability of the banking industry in the UAE can also be attributed to the increased capitalization levels of the banks. It results in an increase in the amounts of capital available for doing business that positioning the banks in the global banking sector.

Financial Analysis of the UAE banking sector

The UAE banks have performed favorably well during the year ended 31 December, 2013. The banks recorded high profit levels in the previous year with an average profit growth rate of 14%. As at the end of the first quarter of 2014, UAE banks recorded increased net profit levels which were aided by the increase in asset growth rates, a decline in the amount of non-performing loans across the industry and high growth potential. The net profits for UAE’s banks are expected to increase at a constant rate of 21% in the future due to the good prospects that exist in the market. The ratio of non-performing loans to loans declined in the year 2013 from 8.7% to 8.1%. The ratio is expected to decrease to 7.4% as at the close of 2014.

By the close of 2014, loans to deposit ratio for UAE banks is expected to be as low as 90%, while the total provision for non-performing loans is expected to be 100%. The specific provision for non-performing loans is also expected to be 80% indicating the high liquidity levels of the banks. Loan deposits in the current fiscal year are forecasted to grow at a rate of 11%, which are tied to the property segment. The banking industry in this market segment is hence expected to grow moderately over the coming years, thus making Abu Dhabi the hub of investment within the Middle East region. The Dubai government’s Debt to GDP ratio stands at 132%, this has not negatively impacted on the banks’ performance. The Dubai banking industry has contributed positively to the global economic recovery strategy in addition to improving corporate governance frameworks and transparency in financial reporting.

The ADIB Ratio Analysis

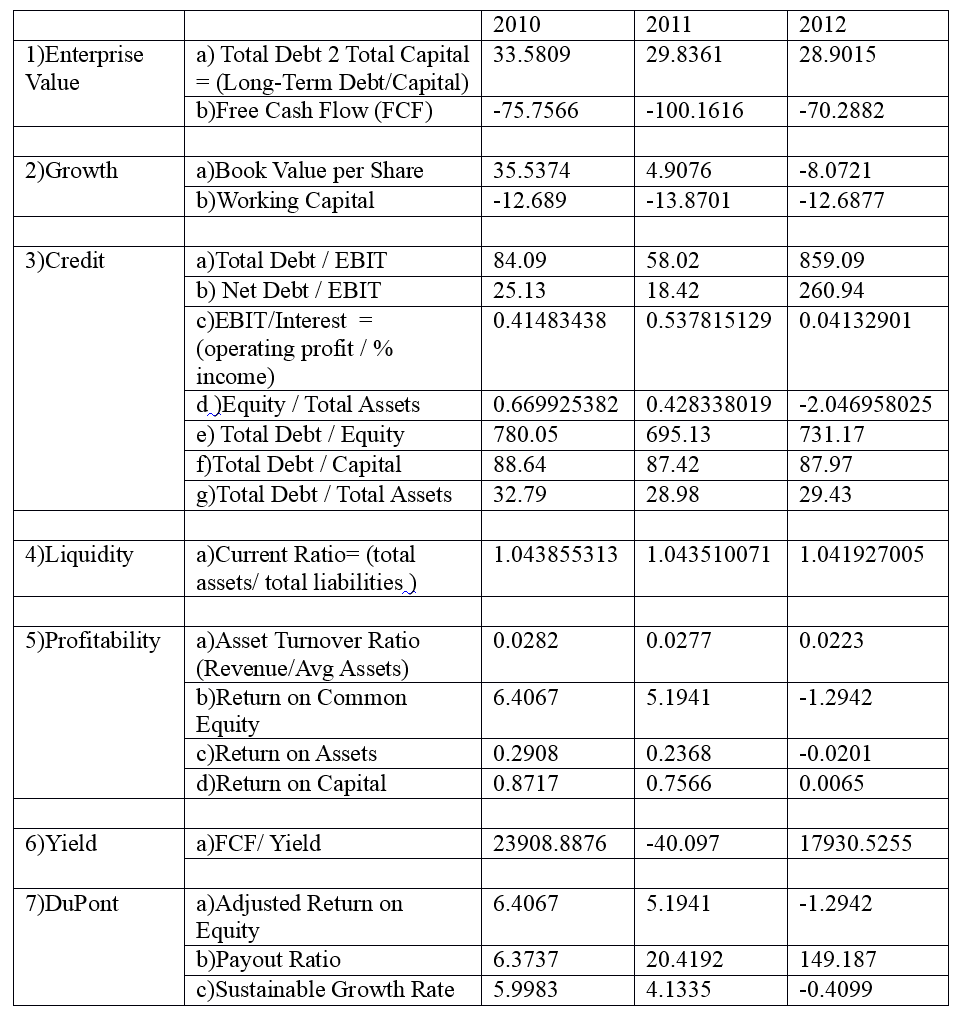

The firm’s growth potential in 2012 is bright given an increase in the book value of its shares of 12.0972. Working capital also increases up to 34.2113 indicating a rise in the operations of the firm. The enterprise value is negative in 2010 at -136.016, it increases to 2562.482 in 2011 and declines to -1319.321 in 2012. The total debt to equity ratio is relatively moderate and declines over time. The ratio declines from 78.06 in 2010, 76.09 in 2011 and 60.108 in 2012. It indicates a decline in ADIB financial leverage over time. The net debt/EBIT ratio is negative at -14.68 (2010), -11.03 (2011) and -14.86 (2012). The firm’s credit rating and liquidity are improving over time.

The current ratio is given as 1.12 in 2010, it slightly increases to 1.13 in 2011 and to 1.17 in 2012. The increase in this ratio indicates the increasing ability of the company in paying its short term obligations using the current assets. The return on equity is high at 13.42 in 2010. The ROE ratio increases to 13.85 in 2011 and declines to 11.34 in 2012. The dividend payout rate is relatively calm at an average of 50.0190333 over the three year period. The firm’s sustainable growth rate increases from 6.7 in 2010 to 6.9 in 2011. It declines to 5.7 in 2012 indicating a decline in its growth potential.

Literature review

The paper relies on a number of research material to highlight the relevant financial statement analysis of the various international banks.

Barth, 2014 gives a highlight of the conceptual framework of financial reporting. The measurement concept of accounting is identified by highlighting on financial reporting objectives, assets and liabilities definition and defining the qualitative characteristics. It is important to understand these concepts given that they impact the financial statement. The CFO Research Services gives an analysis of the importance of numbers that are contained in the financial statements. The paper indicates the relative importance of financial report’s narrative portions and their contribution to the quality of financial reporting. The usability of these reports from manual, users is also highlighted in addition to the mandatory sentences that have to be contained in the financial reports (CFO, 2014). The analysis of the UAE banking sector is greatly emphasized by Augustine B.D. He highlights the strong growth trends in the industry and the role of the UAE government in the sector (Augustine, 2014). The current developments within the Indian banking sector are highlighted by the Indian Brand Equity Foundation. The growth prospects in this industry have had a great impact on major international banks such as Barclays and HSBC. The role of government initiatives and investment opportunities available to the banks are also critically discussed (India Brand Equity Foundation, 2014).

Conclusion

From the results of the ratio analysis, HSBC Bank Plc. Is a highly profitable company with a significant growth potential, especially within Europe. The Emirates National Bank of India (ENBI) is also a highly liquid company given its high current ratios. The bank also offers high returns on investment as indicated by the high dividend payouts. Barclays Bank Plc. is the worst performer in the banking sector, owing to the poor strategy adopted by the firm with regards to personal and corporate banking. The Abu Dhabi Islamic bank has significant growth potential owing to the growth of Islamic banking in the world.

Appendix

Appendix 1: HSBC Bank Plc. Financial ratios

Appendix 2: Emirates NBD financial ratios

Appendix 3: Barclays Bank financial ratios

Appendix 4: Abu Dhabi Islamic Bank